A Study of Bitcoin Acceptance in Korea

Copyright ⓒ 2019 The Digital Contents Society

This is an Open Access article distributed under the terms of the Creative Commons Attribution Non-CommercialLicense(http://creativecommons.org/licenses/by-nc/3.0/) which permits unrestricted non-commercial use, distribution, and reproduction in any medium, provided the original work is properly cited.

Abstract

This study examines the spread of Bitcoin worldwide, specifically, where and why it has and has not been accepted, focusing on South Korea. The analysis covers the new forms of currency that have been privatized and how state authorities have monopolized all rights to currency as a tool for economic management through the central bank, after the extinction of private currency. First, the examination identifies the basis on which countries decide whether they will treat Bitcoin as a digital currency, impose taxes, or recognize it as a currency, in their approach to regulation. Second, it confirms that governments believe in keeping their exclusive rights to currency in accordance with conventions and traditions. Third, analyzing public media reports, it categorizes types of regulations on the basis of severity, and identifies the causes behind varying degrees of regulation among different countries by assessing situational examples. The nature and extent of a country’s Bitcoin usage depends on its domestic and international circumstances and political commitment. One limitation of this study is its lack of quantitative research. Further research on this topic is necessary, with future studies including more countries for more significant outcomes.

초록

본 연구에서는 새로운 형태의 민간화폐에 대한 화폐창출의 민간화 과정을 살펴보고 민간화폐제도의 소멸 이후 중앙은행제도를 통해 국가 권력이 국가경제운영의 도구로 활용되는 화폐에 대한 권한을 독점하는 과정과 중앙은행이 새로운 유형의 민간화폐인 Bitcoin의 등장에 대하여 부정적인 입장을 취하는 이유와 다른 나라의 규제차이를 분석하였다. 첫째, 개별 국가의 Bitcoin 규제수준을 정하는데 전자화폐로 접근할 것인지, 과세를 적용하는 형태의 규제를 실시할 것인지, 화폐로 인정할 것인지에 대하여 판단 근거에 대한 결정이 이루어지지 않은 단계이다. 둘째, 국가는 화폐에 대한 전권을 소유해야 한다는 전통적 관점을 유지하고 있다. 셋째, Bitcoin의 속성과 현황에 기초하여 다른 나라의 규제현황과 규제수준 등을 각국 정부와 중앙은행의 발표, 공신력이 있는 언론보도를 기초로 분류하였고, Bitcoin을 화폐의 기능적 관점에서 사례분석을 통하여 각국의 규제에 차이가 나는 이유를 규명하였다.

Keywords:

Bitcoin, regulation status, regulation level, taxation, virtual currency키워드:

비트코인, 규제 상황, 규제 수준, 과세, 가상화폐Ⅰ. Introduction

For many decades, the power to issue currency has been vested solely in the state, which has used it to strengthen a country’s national identity and bond within the scope of its sovereignty, as tax revenue for economic management, and as a means to deter the political and economic influence of other countries [1]. Bitcoin first appeared in 2009 and has counteracted the belief in the state’s exclusive rights to issue currency. It has been recognized as a unique form of currency and has slowly extended its reach, even becoming accepted as legal tender in some countries [2]. Ostensibly, Bitcoin could enable anyone to issue currency and operate without central authority or banking through its use of blockchain technology and peer-to-peer networking, which ensures trust among its users [3].

As of 2014, Bitcoin has been accepted as a mainstream currency in countries such as the United Kingdom, Germany, Japan, and Spain. Considering the failures of e-gold in the United States and Q-Coin in China, Bitcoin’s recognition in the aforementioned countries is indeed unusual [4].

Bitcoin is a digitized and intangible currency, and thus, has many limitations in being nationally accepted. In light of the Cyprus financial crisis in 2013, digital currency was originally introduced to facilitate informatization and digitization of banking, and to enhance the efficiency of payments and settlements [4]. The introduction of Bitcoin requires technical, economic, and political commitments. In fact, a political commitment of the state is necessary to create a new monetary sphere. This study seeks to identify the factors that could influence the introduction of Bitcoin in countries such as South Korea. Considering the recognition of private currency in the past and regulations against digital currency preceding Bitcoin, an analysis of Bitcoin can be valuable in assessing the prospective expansion of private currency. Given Bitcoin’s short history and lack of quantitative information, this study was conducted based on information published by renowned institutions, including national reports on virtual currency and press releases.

Ⅱ. PREVIOUS RESEARCH

2.1 Private Currency

As bitcoins are now issued by private entities and have assumed the status of legal tender or a medium of purchase in some countries, an analysis should begin by examining existing studies on private currency. According to a comparative study of private monetary systems, during the free banking era, an efficient currency management through competition was possible with private banks issuing and managing currency, which was followed by governments assuming various rights through central banking, such as exclusive issuance of currency and employment of macroeconomics. Between 1722 and 1844, currency was issued by private banks in 55 countries and competition between private banks was integral to maintaining stability and order [5]. In 2008, the global financial crisis added to the distrust of the central banking system and led to the creation of currency by the private sector.

2.2 Digital Currency vs. Bitcoin

Today, digital currency is subject to surveillance and supervision by a government entity as mandated by law and has different exchangeability and usage restrictions than Bitcoin. Digital currency is a legal tender issued and managed by the state, while Bitcoin does not have the same status as digital currency when it comes to negotiability, versatility, store of value, liquidity, scope for government supervision, exchangeability, and usage range.

First, Bitcoin is not subject to government management nor is it subject to its surveillance or supervision, meaning there is no legislation to guide its operation. Second, Bitcoin is operated independently from conventional legal tender. Third, Bitcoin is regulated by the invisible hand of the market, making its production and management unstable, which poses a certain degree of risk in terms of credit. On the other hand, Bitcoin is being accepted widely by not only online websites but also offline stores, owing to its relatively low social cost and higher efficiency than conventional currency [5-6].

Bitcoin is gaining attention in Korea owing to its anonymity and low transaction fees. Its growing popularity can also be attributed to the public anticipating its rising prices. Bitcoin has also enabled purchases at prepaid stores like Amazon. Trustnodes, a website that covers topics related to cryptocurrency, reported that the latest previously “bitcoin only” service provider to diversify following stupendous fees and network congestion might be Purse, an intermediary that matches Amazon gift card owners with bitcoiners–and now perhaps bitcoin cash–allowing consumers to purchase on Amazon at a discount, using digital currencies.

However, the anonymity of bitcoin, makes it an ideal tool for money laundering, similarly to a direct cash exchange. Despite its strengths, such as lower transaction fees than conventional currencies, anonymity, convenience, and faster transactions, its increase in users is expected to slow due to high price volatility and technical complexity, which makes bitcoin vulnerable to hacking [7].

Ⅲ. BITCOIN REGULATION

3.1 Virtual Currency Acceptance

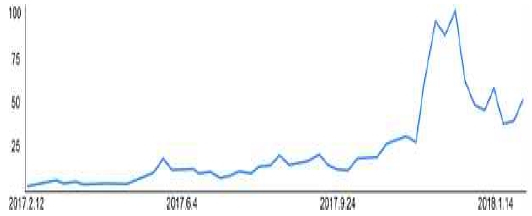

In 2017, Bitcoin ranked second among top searches in the “Global News” category [8]. Since the first Bitcoin transaction on May 18, 2010, up to 8 trillion won in bitcoins were issued as of July 2014; and according to coinmap.org, which provides a directory of bitcoin venues, as of January 24, 2018, 11,662 venues were accepting Bitcoins globally [9]. As shown in Figure 1, public interest in bitcoins skyrocketed at the end of 2017, according to Google Trends [10].

3.2 Bitcoin Acceptance in South Korea

Currently, the South Korean government is against accepting bitcoins as legal currency. Its financial authority regards it as a form of illegal fundraising. However, the government added that it will support and promote the development of blockchain technology (which reduces the risk of hacking by encrypting and distributing transaction information) to be used by financial firms [11].

Ⅳ. REGULATION MEASURES

Regulatory measures for Bitcoin can be divided into five degrees of severity. First, it can be recognized as a currency, meaning it will be granted the status of legal tender—this is the weakest regulation. Second, it can be recognized as a “method of payment”—in this case, Bitcoin’s liquidity is not accepted nor does it have legal status as a currency but it can be used to purchase both virtual and real goods and services. Third, “guideline, regulation, and taxation” can be applied, which acknowledges Bitcoin but with strong regulations around its use. The United States is an example of this regulation, with tax imposed on Bitcoin trades. Fourth, it is “banned,” as it is in Russia and China—here, Bitcoin is not acknowledged as a currency, people are not permitted to engage in private or financial transactions and exchanges, and they are warned of its dangers. In other words, the government does not recognize anything else outside the legal tender. Fifth, it can be handled with “indifference” where the government is unresponsive to the use of Bitcoin owing to the lack of relevant laws and regulations.

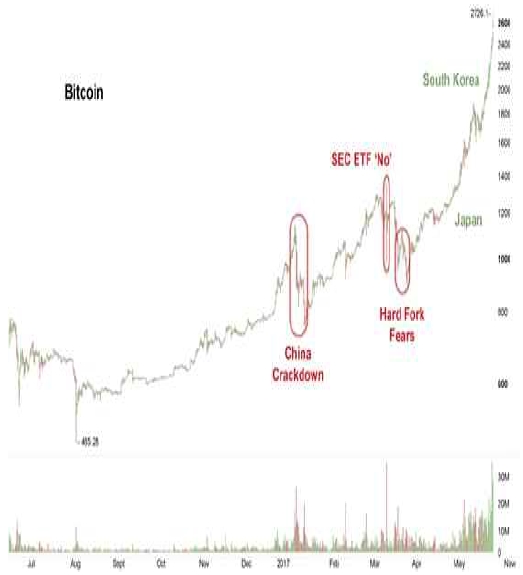

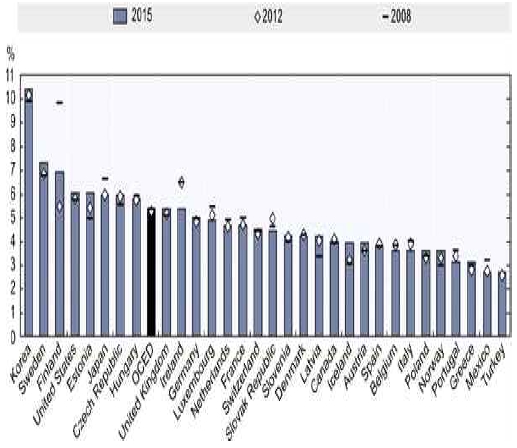

Recently, in Japan, the demand for bitcoin has increased exponentially but has been surpassed by demand in South Korea, as shown in Figure 2 [12]. Figure 3 illustrates the increase in value added in the information and communications technology (ICT) sector for OECD nations [13].

An analysis of virtual or crypto-currency regulation and censorship in different countries can be summarized, as shown in Table 1 [14-15].

An analysis reveals that bitcoin regulations are tied to the national aims of each country. A country’s reception or regulation of bitcoins is influenced by factors such as its level of ICT development, economic power, status of its financial markets, and its stability. A country’s final and conclusive position on bitcoins may vary depending on its national priority and goals. National goals, which depend on the unique circumstances of each country, stand above technological, financial or economic factors when it comes to determining the extent of bitcoin regulation. Such national aims can be categorized as 1) technological innovation and development, 2) consolidation and stabilization of the domestic currency, 3) ensuring public safety and preservation of the state, and 4) pursuit of economic and political supremacy. For the world's leading economic and political powerhouse, the United States, there seems to be no particular goal to pursue using bitcoins. Instead, it has focused on the potential risks that Bitcoin poses to its vested interests and has worked towards strengthening these further through industrial success. On the other hand, the United Kingdom (UK) has been at the forefront of adopting bitcoins. Its government took preventive measures against the illegal use of Bitcoin through activities such as money laundering, and established a state exchange market that guarantees transparency; it also imposed regulations and taxation. This can be seen as a move to become a dominating, financial powerhouse in the currency wars ahead.

Since Bitcoin is an intangible currency that can only exist in online networks, it cannot be confiscated and its production cannot be halted. In response to this, China has ceased the operation of Bitcoin’s market and payment systems and prohibited the selling of devices and software programs needed to create bitcoins; it has also used its central authority to illegalize bitcoin exchange and trading. For China, consolidating the status and security of the Chinese yuan as an international currency is a bigger national priority than adopting bitcoins; this has manifested in harsh regulatory measures and unwillingness to recognize Bitcoin as a currency. The UK has recognized Bitcoin as a currency and is withdrawing the imposition of various taxes in its effort to become a leader in the FinTech industry. On the other hand, France does not have a local currency or a need to pursue particular hegemony; thus, it has no national agenda to fulfill through Bitcoin. It also regards Bitcoin and other virtual currencies as a risk to security and the potential root of social problems. The French Ministry of Finance demanded that bitcoin exchanges and other companies provide the IDs of the traders and report income from bitcoin trades. Argentina, which is struggling to cope with its own financial crisis and political instability, can afford little room to contemplate the counter-effects of Bitcoin or pursue national priorities via Bitcoin. Thus, Argentina’s response to Bitcoin can be described as indifferent or neutral. Despite its active domestic Bitcoin market, the Argentinean government has not expressed any particular stance on regulations.

These responses could be applied to other countries also. Notably, many countries are wary of the adverse effects of Bitcoin. Such effects include its anonymity, hacking risks, deflation, and imperviousness to the central bank’s influence. South Korea is aware of the possibility of the abuse of Bitcoin through money laundering, illegal trading, financing of terrorist groups, tax evasion, and facilitation of the underground economy, as well as the possibility of it disabling monetary policy. Even if a country is equipped with both technical and economic infrastructure for proper functioning of Bitcoin, as well as countermeasures against its adverse effects, Bitcoin needs to withstand the ultimate test of adherence to the national agenda before it can be acknowledged and accepted. Bitcoin regulation can be accurately and comprehensively understood when Bitcoin’s alignment with a national agenda and its priorities is considered along with environmental criteria. The South Korean government has recently announced its plans to introduce a nationwide regulatory framework for Bitcoin exchanges and brokerages. In addition, the South Korean ministry of finance and strategy has drafted taxation policies on Bitcoin trading.

Ⅴ. CONCLUSION

This study examined the history of new forms of currency, how they have been privatized, how state authorities have monopolized the rights to currency, as a tool for economic management through central banks after the extinction of private currency, and why governments are opposed to Bitcoin as a private currency currently on the rise.

The South Korean Bitcoin exchange market accounts for nearly seven percent of the global Bitcoin market share. As major financial institutions enter the Bitcoin market, an increasing number of general consumers and investors will invest in Bitcoin in the long-term.

The analysis reveals the following.

First, each country’s approach to Bitcoin regulation is based on whether they will: 1) treat Bitcoin as a digital currency, 2) impose taxes, or 3) recognize it as a currency. Second, it confirms that governments believe in keeping their exclusive rights to currency in accordance with conventions and traditions. Third, using public media reports, such as announcements by individual governments and central banks, existing Bitcoin regulations were categorized and the causes behind varying degrees of regulation among different countries were identified through a situational analysis assessment.

The research revealed that Bitcoin is used as a method of payment in many countries and has been acknowledged as legal tender in the UK; however, whether it can replace other legal tender remains to be seen. Its excessive anonymity and the lack of management and supervision of central banks may create many issues, such as credit uncertainty, unstable store of value, and imperviousness to government control. It is anticipated that significant time will be needed to formulate a solution to such predicaments and ensure the stable operation of Bitcoin.

Research on ICT development and application and building the underlying infrastructure must precede the deployment of Bitcoin as a legitimate form of currency in everyday life, along with economic and political stability. In terms of politics, countries must work together to agree on a position and create policies for Bitcoin. Discussion on the illegal use of Bitcoin among member countries of the Financial Action Task Force will help address the criminal activities facilitated by bitcoins. The conditions required to create bitcoins must be assessed to understand and institute a regulatory framework. The examination of the situational examples discussed in this study concludes that the nature and extent of a country’s Bitcoin usage depends on its domestic and international circumstances and political commitment. For instance, countries may have chosen a centralized banking system because they need centralized management of their national economy. Whether it is acceptance, caution, illegalization, or indifference, each country’s attitude toward Bitcoin is likely tied to its political resolution.

One limitation of this study is its lack of quantitative research. Further research on this topic is necessary, with future studies including more countries for more significant outcomes.

Acknowledgments

이 연구는 2019년도 협성대학교 교내연구비 지원에 의한 연구임(No. 2019-0013).

References

-

J. Cohen, “Defining Identification: A Theoretical Look at the Identification of Audiences With Media Characters”, Mass Communication & Society, 4(3), p245-264, (2001).

[https://doi.org/10.1207/s15327825mcs0403_01]

- G. Ingham, "The Nature of Money", Economic Sociology: European Electronic Newsletter, 5(2), p18-28, (2004).

- N. Yukio, (2018, January), Bitcoin remittances began to be accepted by the general public, [Online] Available: https://www.coinmis.com/japanese-scholar-yukio-noguchi-bitcoin-remittances-began-to-be-accepted-by-the-general-public/.

-

B. Lietaer, "The Future of Money: Towards New Wealth, Work and a Wiser World", European Business Review, 13(2), (2001), [Internet].

[https://doi.org/10.1108/ebr.2001.05413bab.008]

- D. H. Yang, "Research Trends in Monetary Finance History", Korean economic journal, 54(1), p321-352, (2015).

- e-Finance and Financial Security, p25-51, (2017), [Internet] Available: https://www.fsec.or.kr/common/proc/fsec/bbs/146/fileDownLoad/1128.do.

- A. Back, "Hashcash - a denial of service counter- measure", Korean Computers and Accounting Review, (2002), [Internet] Available: http://www.hashcash.org/papers/hashcash.pdf.

- SegyeIlbo, (2017), [Internet] Available: http://www.segye.com/newsView/20171229003504.

- ChosunIlbo & Chosun.com, (2018), [Internet] Available: http://biz.chosun.com/site/data/html_dir/2018/01/25/2018012500271.html#csidx493659da64492c9a2563eb4479ce90a.

- GoogleTrends, (2017), [Internet] Available: https://trends.google.com/trends/explore?q=bitcoin.

- S. Y. Hong, "gBitcoin, the state of entry into the system by country,ountry, News", Journal of Digital Contents society, (2017), [Internet] Available:http://www.econovill.com/news/articleView.html?idxno=327890 (in Korean).

- T. Durden, (2017, May), Bitcoin Explodes, Trades Above $4,000 In South Korea, Zero Hedge, [Internet] Available: https://www.zerohedge.com/news/2017-05-25/bitcoin-blows-throuigh-2500-2600-2700-overnight-south-korea-demand-soars.

-

OECD Digital Economy Outlook 2017, (2017, September 9), p118, [Online] Available: http://oe.cd/disclaimer.

[https://doi.org/10.1787/888933584735]

- B. Yuthika, B, (2017, July 13), Bitcoin trade may come under SEBI, [Internet] Available: http://www.thehindu.com/business/Economy/bitcoin-affords-anonymity-in-grey-area/article19265595.ece.

- Blockinpress, (2018,March18), [Internet] Available: https://blockinpress.com/archives/3571.

저자소개

1992 : 숙명여자대학교(경영학석사).

1998 : 숙명여자대학교(경영학박사).

2002~현재 : 협성대학교 글로벌경영대학 금융세무학과 교수

※관심분야 : 관리회계, 회계정보시스템