A Study on Accounting Education Using the AT Program

Copyright ⓒ 2019 The Digital Contents Society

This is an Open Access article distributed under the terms of the Creative Commons Attribution Non-CommercialLicense(http://creativecommons.org/licenses/by-nc/3.0/) which permits unrestricted non-commercial use, distribution, and reproduction in any medium, provided the original work is properly cited.

Abstract

The objective of this study is to explore an approach to teaching accounting that uses AT programs to stimulate students’ interest in accounting and analyze information using the program. First, what is the AT(Accounting Technician) program and why do universities use the program to teach accounting? The AT program is an accounting software program provided by the KICPA( Korean Institute of Certified Public Accountants) free of charge that can be installed and used anytime and anywhere. Second, how can the AT program be applied to teach basic information management? The program enables users to issue electronic tax invoices for taxable sales, and process sales and purchase transactions and settlements to complete financial statements. Third, how can accounting information be analyzed using the AT program? One example is calculating depreciation expense. Therefore this makes it possible to teach students how to analyze the characteristics and contents of data before entering it and to stimulate students’ interest .

초록

본 연구의 목적은 회계 소프트웨어 프로그램을 통한 교육이 회계에 대한 학생들의 관심을 유발하고 정보 분석에 도움이 되는지를 연구하는 것이다. 첫째, 회계 소프트웨어 프로그램 중 AT(Accounting Technician) 프로그램은 KICPA( Korean Institute of Certified Public Accountants)에서 무료로 제공하는 회계 소프트웨어 프로그램으로 언제 어디서나 설치하여 사용할 수 있으며 경제적이라는 장점이 있다. 둘째, 정보 분석에 AT 프로그램을 적용할 수 있고 본 프로그램을 통해 사용자는 과세 대상 판매에 대한 전자 세금 계산서를 발행하고 판매 및 구매 거래 및 정산을 처리하여 재무제표를 완료 할 수 있는 방법을 숙지할 수 있다. 셋째, AT 프로그램을 사용하여 복잡한 회계계산을 가능하게 한다. 한 가지 예는 감가상각비를 계산하는 것이다. 그러므로 AT 프로그램은 데이터의 특성과 내용을 분석하는 방법과 학생들의 흥미유발에 도움이 된다.

Keywords:

AT program, accounting education, accounting information, depreciation expense, financial statements키워드:

AT프로그램, 회계교육, 회계정보, 감가상각비, 재무제표Ⅰ. Introduction

We are living in the era of the 4th Industrial Revolution. The current wave of the revolution led by intelligence-information technology such as AI(Artificial Intelligence) and IoT(Internet of Things) has ushered in dramatic changes for education[1]. The number of hours spent using computers is increasing in many areas of business and education, including accounting. Accountants are required to report on a substantial amount of data amid the flood of accounting information. Core competencies required in the future will be increasingly complex and specialized and require the ability to solve problems, process information, and communicate effectively.

Accounting is a discipline that presents useful information for internal and external stakeholders in the form of financial statements; despite its interesting aspects, many students do not understand the basic principles or meaning of accounting [2]. University accounting classes should teach students how to understand and analyze practical data and interpret the meaning of the data. To accomplish this, new and effective measures of accounting education are needed [3,4].

The objective of this study is to explore an approach to teaching accounting that uses AT programs to stimulate students’ interest in accounting and analyze information using the program. This is an analysis of how using accounting technician (AT) programs to teach accounting is an effective way to train students to better understand, organize, and analyze large amounts of data.

Ⅱ. PREVIOUS RESEARCH

2.1 THEORETICAL BACKGROUND

To guarantee competitive information, more base information is required and a thorough understanding of the information’s quality is a prerequisite [5,6]. Rainer and Watson [5] used criteria such as accuracy, timeliness, conciseness, convenience, and validity to measure the quality of information. Timeliness of information is the degree to which information created by an accounting information system is provided to the user when needed. An additional measure of quality information is usefulness. Usefulness of information is the degree to which a stakeholder uses information created by an accounting information system for decision making [7,8].

Since information influences decision making, users are satisfied when the information they have is of high quality. The perceived degree of efficiency affects the value of an information system’s output as an additional indication of the quality of the information and its contents. Overall, the information system of the AT program used for education produces good quality information.

2.2 ACCOUNTING EDUCATION USING THE AT PROGRAM

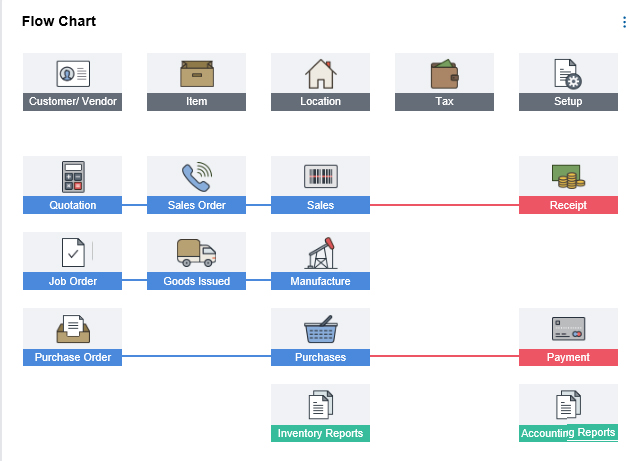

In the information society, corporations depend on information technology to deal with every task. A company’s accounting information is computerized through an accounting information system so it is necessary to equip future accountants with both the theoretical background and practical ability to prepare them for the real business world [7]. The AT examination, supervised by the KICPA(Korean Institute of Certified Public Accountants), was created in 2013 to focus on practical, rather than theoretical knowledge [9], and its content is 30% theoretical and 70% performance. The latter evaluates the applicant’s ability to deal with tax and accounting tasks using the AT software on the computer as shown in Figure 1.

Some universities have created special courses for students interested in the qualification test. The AT program can be a key mediator in experiential learning. It can promote successful educational reform, which has long been a dream of educators, and serve as a multi-purpose tool to help accomplish academic goals [10,12]. One of the advantages of the AT program for educational use is that it is free software, which means that users can easily add contents and the analysis tool is available almost real-time.

Ⅲ. COMPUTING ABILITY

Computing ability means the ability to use information technology, including the basic computer literacy necessary to learn computerized accounting [11,12]. The AT program (smart A) is software adopted for the AT certification test by the KICPA and is provided free to educational facilities for educational purposes. The computing ability required to learn the AT software includes the ability to use basic information technology, such as entering basic data, registering prior period financial statements, word processing skills, and internet skills to download back data needed to study for the performance test.

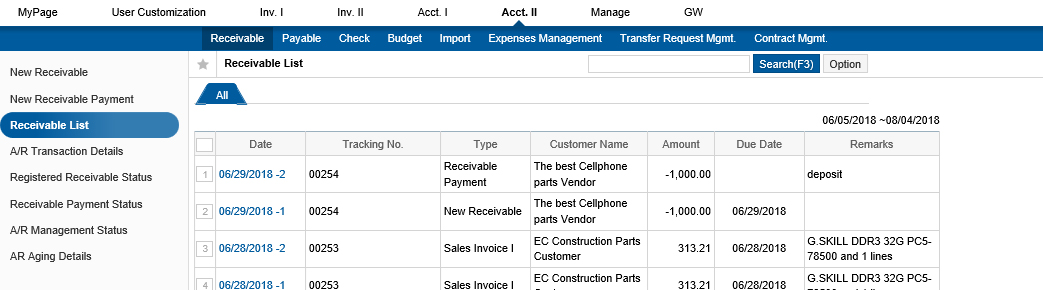

The purpose of an accounting information education is to help students obtain a license, which will give them an advantage in their job search and allow them to get a better job. Students are required to understand overall business and tax accounting and master practical accounting skills using a computer as shown in Figure 2, 3[12].

Currently, Korea’s universities do not have an adequate number of computerized labs and many of the facilities are worn out and need to be replaced. To make matters worse, the computers they do have are often slow and poorly maintained; however, universities are not investing enough in computerized facilities. It would be almost impossible to learn computerized accounting in this unfavorable environment given the lack of computing facilities.

Ⅳ. CHARACTERICTICS OF AT CERTIFICATION

It is important to have systematic knowledge about business and tax accounting to obtain the AT certification. Having a theoretical background and the ability to use practical skills in business and tax accounting tasks is necessary to be able to adjust to organizations’ various accounting programs and information systems and deal effectively with practical tasks. The AT test is a state certified test that grades professional knowledge of business accounting and accounting competence into TAT(Tax Accounting Technician) Levels 1 and 2 and FAT(Financial Accounting Technician) Levels 1 and 2. The test, with its focus on current tax laws and financial accounting standards, is 30% theoretical (objective multiple-choice questions) and 70% performance (Figures 2 and 3 illustrate the AT program installed on computers). The former measures the test-takers’ knowledge of tax and business accounting while the latter evaluates the ability to deal with practical tasks.

The AT examination is divided into FAT and TAT. The AT test evaluates the test-takers’ ability to perform such tasks as keeping a ledger, settling accounts, and looking up information using the AT program. Test-takers are graded into FAT Level 1 or 2. The AT test also measures the capability to perform tax-related tasks, such as reporting VAT(Value Added Tax) and withholding tax or dealing with other tax-related jobs for a corporation and test-takers are also graded into TAT Level 1 or 2. TAT Level 1 is the highest grade one can get and indicates that the individual has knowledge about financial accounting, cost and management accounting, and tax accounting (corporate tax, income tax, and VAT) and is competent to conduct all tax accounting tasks [7].

The purpose of the AT certification examination is to nurture a professional workforce equipped with accounting competencies. The KICPA has been commissioned to conduct a fair and strict test that will help guide tax and accounting education in universities, provide talent to businesses, offer job opportunities, and cultivate a specialized workforce, contributing to the development of the national economy.

Ⅴ. CONCLUSION

This study discussed important questions and made suggestions about using the AT program to teach accounting. First, the study clarified what AT software is and why universities apply it to accounting education. Second, how AT software can aid in teaching basic data management was discussed. Creating financial statements through basic data management is easier than learning by theories and tasks such calculating depreciation cost can be taught without relying only on formulas and theories. This makes it possible to teach students how to analyze the characteristics and contents of the data before entering them. Third, the study examined how accounting information can be analyzed using the AT program. As an example, the program enables users to issue electronic tax invoices for taxable sales and to process sales and purchase transactions and settlements to complete financial statements. Because the AT program is provided free of charge, it can be installed and used anytime and anywhere.

Suggestions about using the AT program to teach accounting can be summarized as follows.

First, accounting education in colleges still revolves around theories. However, a new teaching method is needed in accounting. Students would benefit from using the AT program to better understand the practical aspects of accounting.

Second, it is important to encourage professors to use the AT program as an instruction tool in classes. In this era of information where data analysis using accounting information is rapidly developing, using the AT program will motivate students in accounting classes with its ability to help them visualize information.

This study discussed accounting education using the AT program. At present, accounting is taught in classes based on theories, instead of using computers. It is expected that this study will contribute to inspiring teachers to use the AT program to make accounting more interesting to students. Using the program makes it easier to explain business examples, and as free software for educational purposes, the AT program can be used anytime and anywhere. It is hoped that these advantages will motivate students and help them develop a more self-directed learning attitude.

Acknowledgments

이 연구는 2019년도 협성대학교 교내연구비 지원에 의한 연구임(No. 2019-0013).

References

- L. L. Lim, , J. H., “A Study on the Effects of Accounting Information System Characteristics on Accounting Information System Performance”, Korea International Accounting association, 34, p129-146, (2010).

- I. S. Choi, "A Study on the Taxation Major’s Career Path and Its Change - The Case of Department of Taxation in K University", Korean Academic Society of Taxation, 12(2), p555-583, (2011).

- M. G. Son, G. K. Shin, "Regular Papers : An Impact of Quality and IT Application Ability of Computerized Accounting Program on User Satisfaction and Loyalty: Focusing on Comparison between University Students and Accounting Staff", Korean Association of Small Business Studies, 33(4), p115-135, (2011).

-

R. K. Rainer, H. J. Watson, "The Key to Executive Information Systems Success", Korean economic journal, 12(2), p321-352, (1995).

[https://doi.org/10.1080/07421222.1995.11518082]

- S. N. Lee, "Mediation Effects of BSC Use between the Accounting Information traits and Corporate Performance", Journal of Business Education, 24(3), p227-250, (2010).

-

J. J. Kim, S.G. Yi, "An Effect that the ERP Introduction Factor of Small & Medium Transportation Companies has on the Internal Performance", Korean economic journal, 12(4), p145-156, (2014).

[https://doi.org/10.14801/kiitr.2014.12.4.145]

- J. H. Lee, D. R. Choi, "The Moderating Effect of User Characteristics In Accounting Information System Quality and User Satisfaction", Korean Computers and Accounting Review, 9(2), p29-49, (2011).

- G. K. Shin, "Effects of User Control of Computerized Tax Accounting Program on the Perceived Ease of Use, Perceived Usefulness and User’s Satisfaction", Korean Computers and Accounting Review, 12(2), p21-38, (2014).

- D. K. Kim, "Theory vs Practice in AIS Education", Journal of Business Education, 29(1), p309-325, (2011).

-

S. J. Lee, K. S. Han, "A Study on the Critical Factors Affecting Use Intention of Multi-access Edge Computing(MEC)", Journal of Digital Contents society, 2(3), p613-622, (2019).

[https://doi.org/10.9728/dcs.2019.20.3.613]

-

J. W. Kim, H. I. Jo, B. G. Lee, "The Study on the Factors Influencing on the Behavioral Intention of Chatbot Service for the Financial Sector : Focusing on the UTAUT Model", Journal of Digital Contents society, 20(1), p41-50, (2019).

[https://doi.org/10.9728/dcs.2019.20.1.41]

- A payroll system that helps make managing payroll even easier, [Internet] Available: https://www.ecounterp.com/ecount/product/payroll_overview?p=T3.

1992 : 숙명여자대학교(경영학석사).

1998 : 숙명여자대학교(경영학박사).

2002~현재 : 협성대학교 글로벌경영대학 금융세무학과 교수

※관심분야 : 관리회계, 회계정보시스템